Fha loan how much can i borrow

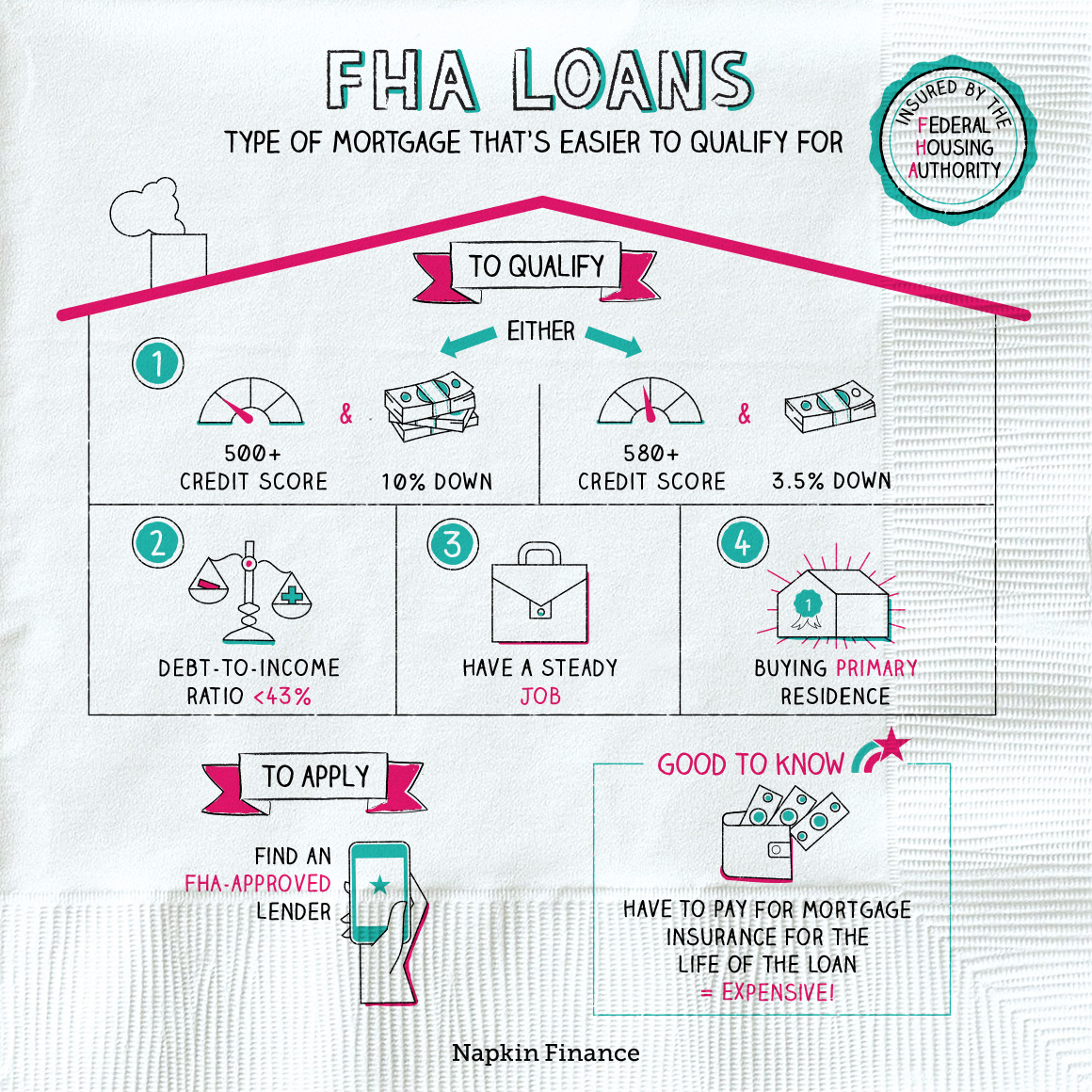

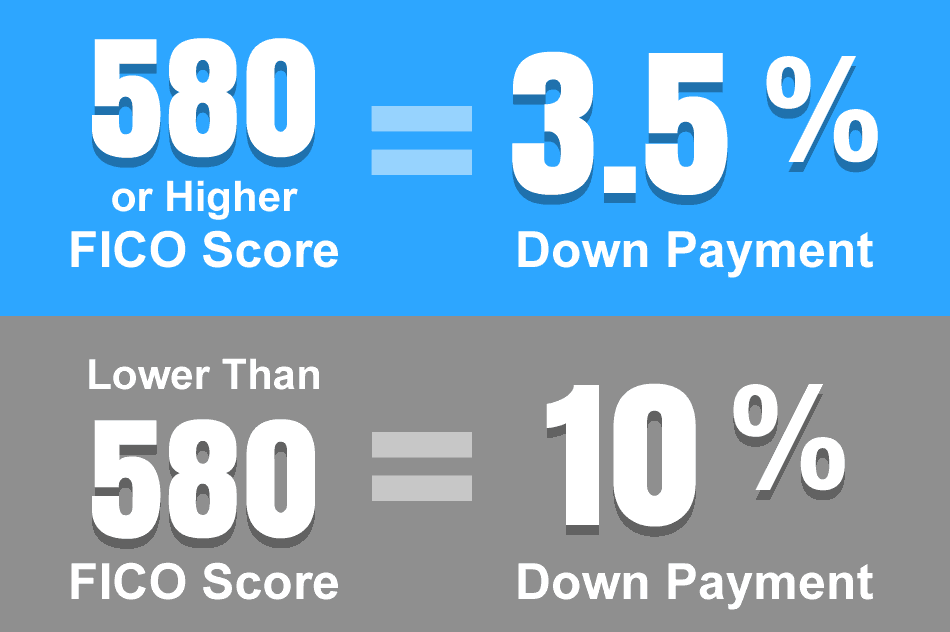

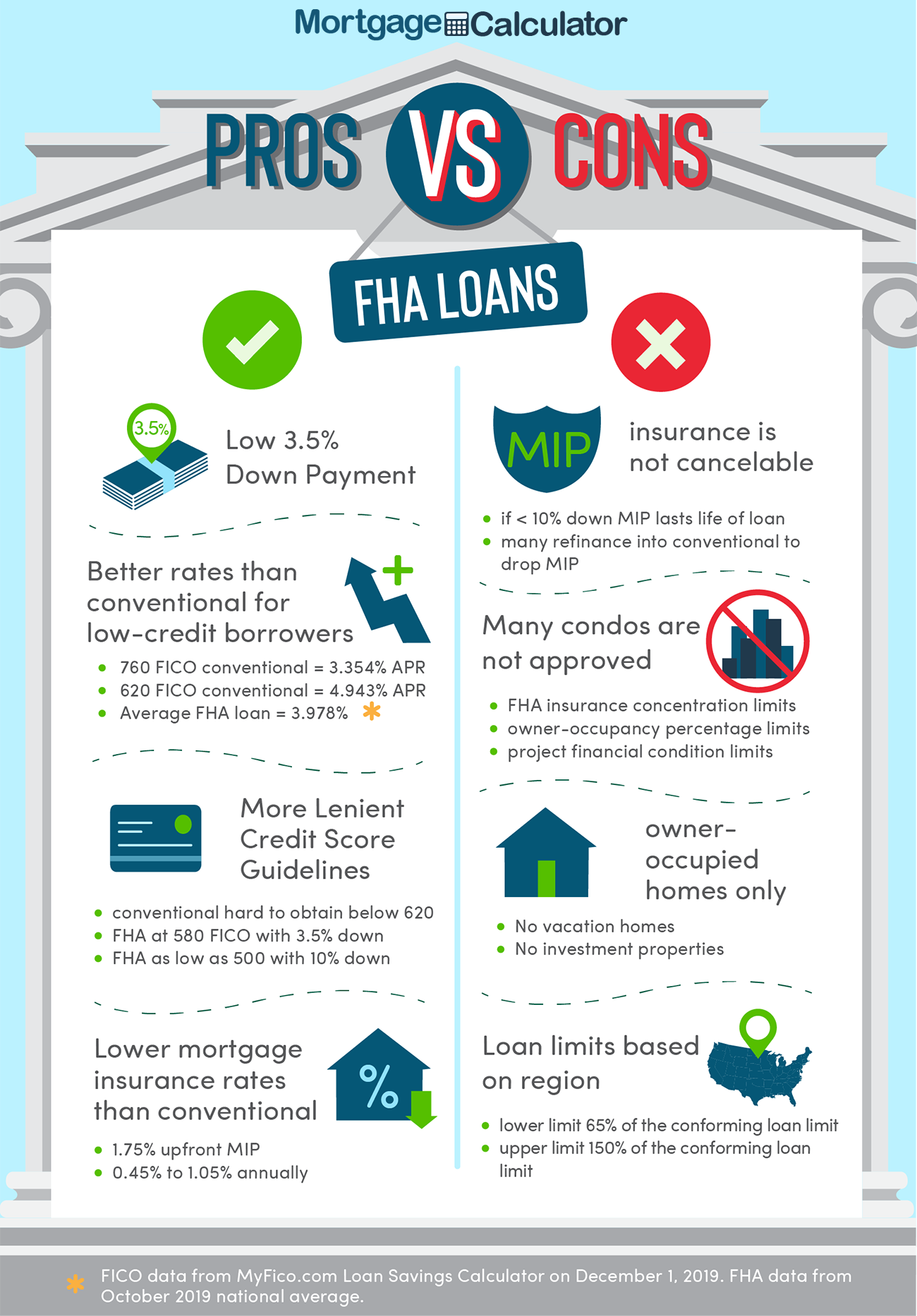

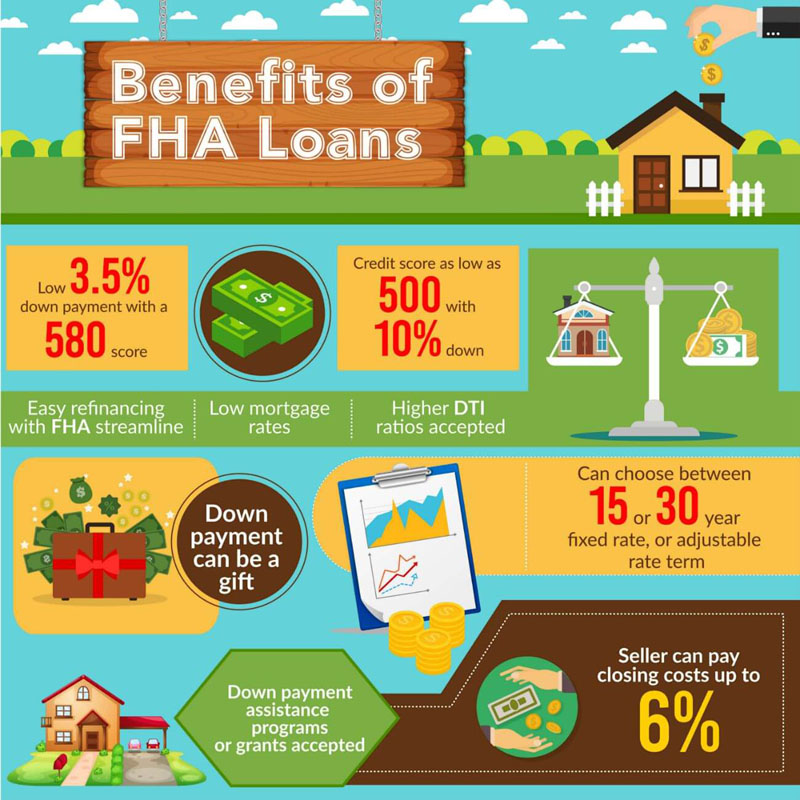

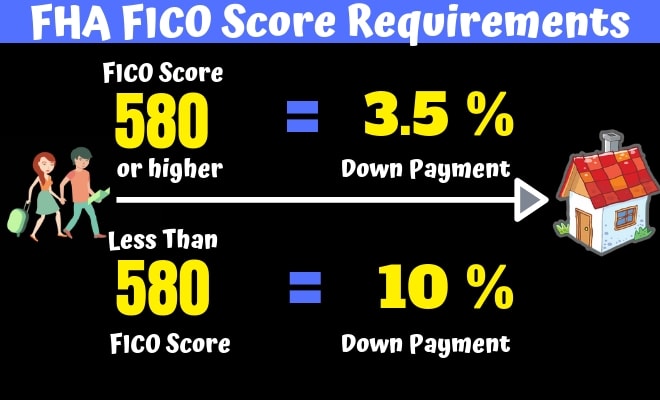

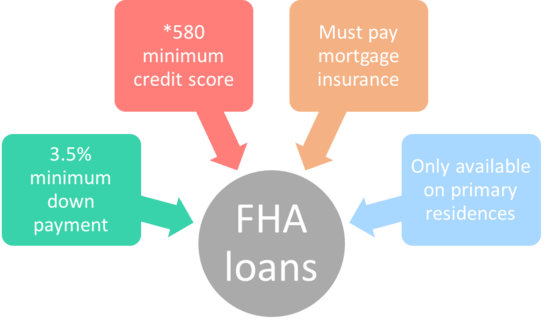

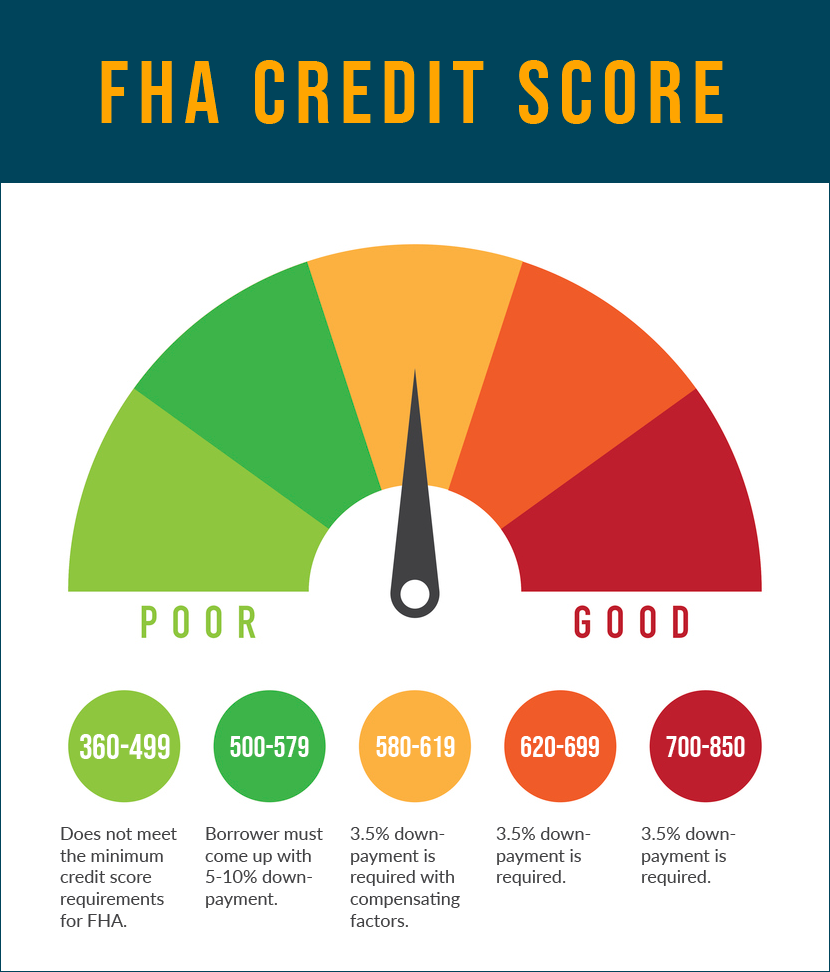

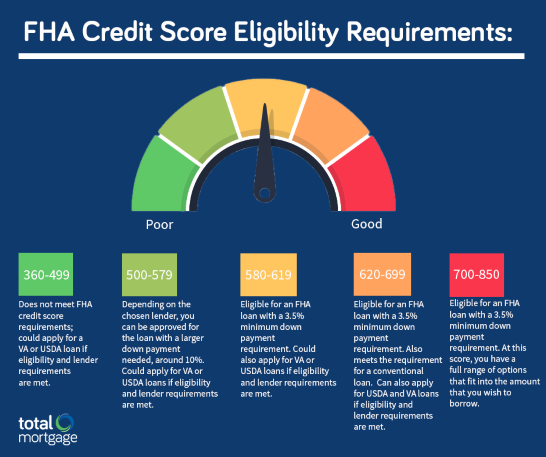

The Nationwide FHA Mortgage Limits. FHA loans allow you to put down as little as 35 if you have a credit score of 580 or better or 10 if your credit score is.

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

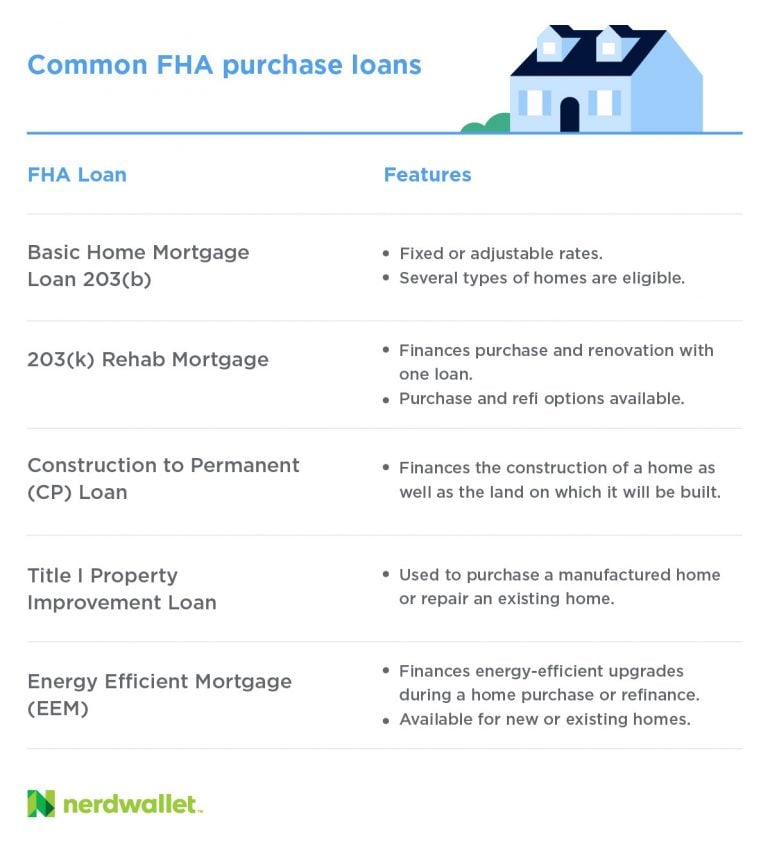

That term can be extended up to 25 years for a loan for a multi-section mobile home and lot.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

. How to borrow from home equity. Such FHA home loans are for owner-occupiers only. Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full.

If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment. With a regular FHA 203k loan the maximum amount you can get on a purchase loan is the lesser of these two amounts. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. With a regular FHA 203k the minimum amount you can borrow is 5000. This mortgage calculator will show how much you can afford.

FHA loans are designed for low-to. HUD 40001 the FHA single family home loan handbook contains a rule stating the borrower must begin using the home purchased with an FHA loan within a specified time after closing usually within 60 days. The terms of an FHA loan for mobile homes include a fixed interest rate for the entire 20-year term of the loan in most cases.

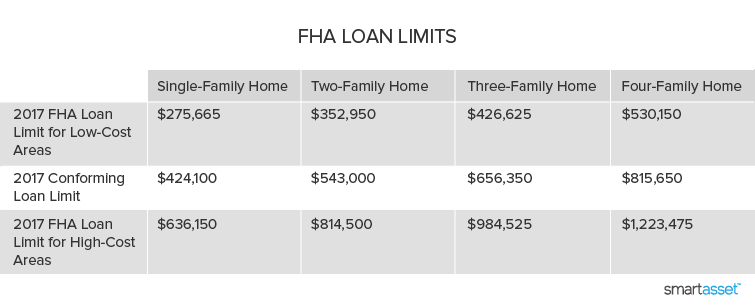

Borrowers with a troubled credit history may have difficulty getting approved by conventional lenders. FHA loans are restricted to a maximum loan size depending on the location of the property. Most mortgages have a loan term of 30 years.

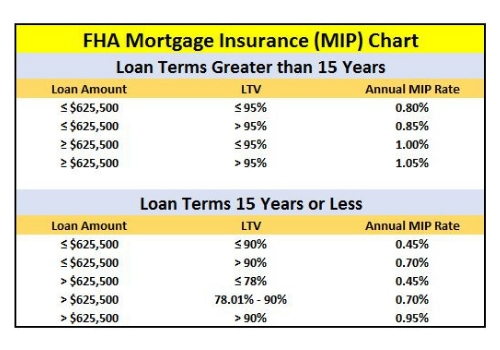

FHA LOAN MAXIMUMS FOR MOBILE HOMES MOBILE HOME LOTS AND HOME-AND-LOT. Since 2010 20-year and 15-year. The appropriate Loan-to-Value LTV ratio from the Purchase Loan-to-Value Limits multiplied by the lesser of.

The maximum term is 15 years for a lot-only purchase. California conforming and FHA loan limits by county. With FHA backing you can often get approved with a low credit score and even a history of bankruptcy or foreclosure.

Keep in mind that generally the lower your credit score the higher your interest rate will be which may impact how much house you can afford. County GSE 1-unit limit FHA 1-unit limit. FHA borrowers must be owner-occupiers for a minimum of one year.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loans Napkin Finance

Fha Mortgage Loan Process Checklist Refiguide Org Home Loans Mortgage Lenders Near Me

Fha Loan What To Know Nerdwallet

Minimum Credit Scores For Fha Loans

Is An Fha Loan Good For You Stem Lending

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Loan Requirements And Guidelines

Benefits Of Fha Loan Phoenix Az Real Estate And Homes For Sale

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Loans Everything You Need To Know

Fha Loan Limits 2022 Update With County Maximums Smartasset Com

Fha Loans Your Complete Guide Loanry

Let S Talk Loan Options Fha Loan Total Mortgage Blog